Month: May 2020

Signs of Economic Life

May 26, 2020

Brian S. Wesbury – Chief Economist, Robert Stein, CFA – Dep. Chief Economist, Strider Elass – Senior Economist, Andrew Opdyke, CFA – Economist

Bryce Gill – Economist

This year’s experiment with government-imposed lockdowns has been a fiasco. We should have been focused on sealing-off nursing homes and limiting mass indoor events, while the vast majority of businesses that were shutdown could have kept operating, with natural social distancing.

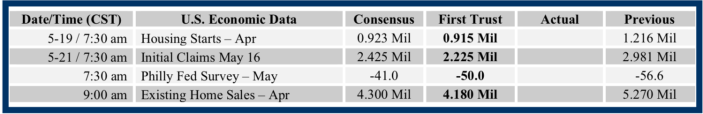

Now, as most people (those that are not elderly or immuno-compromised) realize their health risk is lower than earlier hysterics suggested, and as states loosen up on government-imposed restrictions, green shoots of economic life are appearing. Rail car traffic, hotel occupancy, motor vehicle gas purchases, and air travel are all still down substantially from a year ago, but all have also moved off their lows.

For example, US rail freight carloads are up 3.2% from a month ago, while hotel occupancy is up 9.0%. Gas purchases are up 27.8% from a month ago, confirming what everyone already knew just from driving around. The number of passengers passing through TSA checkpoints rose to 267,451 this past Sunday, versus a Sunday low of 90,510 on April 12, a near tripling of passenger activity. Yes, this past Sunday was a holiday weekend, but last Sunday (May 17) was already up 180% from the low.

In order to tell whether the overall economy is starting to recover, we’re looking for confirmation from unemployment claims and federal tax receipts. The bad news is that new claims for unemployment insurance remain at extremely elevated levels. However, new claims are down substantially from the 6.9 million filed in the last full week of March, we suspect some portion of new claims are fraudulent, and that some recent new claims reflect a backlog from people who lost their jobs in prior weeks. Typically, the average level of initial claims for a month peaks two months before the economy hits bottom. April looks like it was the highest month for initial claims, which signals an economic bottom should come in June.

What is also exceedingly clear is that this recession is not like previous ones. So, we’re also watching continuing unemployment claims, which keep rising. Typically, these peak around one month after the economy hits bottom. So, if they peak soon, that’s a very good sign the economy is already growing again. Unfortunately, continuing claims haven’t peaked yet, and probably won’t do so until at least June.

Another way to assess the overall health of the economy is by monitoring the daily flow of income and payroll tax receipts the federal government is getting through withholdings from paychecks. Using tax receipts to figure out economic trends can be tough, as withheld amounts are volatile from day to day, with big effects based on the day of the week as well as the day of the month. And the pattern of the days in a month changes from year to year (for example, how many Mondays each month has), making comparisons that much tougher.

However, the calendar from 2015 closely resembles the calendar for 2020. Ten of the twelve months have the same number day on the same day of the week (leap year in 2020 means January and February are different), making comparisons much easier.

And what does it show? In the first three months of 2020 (January through March), withheld income and payroll tax receipts were up 19.7%. That’s roughly what we’d expect given economic growth and inflation from 2015 to 2020. But receipts in April 2020 were up only 2.6% versus April 2015, showing how economic activity fell off a cliff. The good news is that, so far in May (through the 21st), these receipts are up 2.9% versus May 2015. That’s less bad than the April comparison, and “less bad” signals more economic activity.

The recession started in March and is the deepest since the Great Depression. However, it may also be the shortest. A full recovery is a long way off. We won’t see the level of real GDP we had in late 2019 again until late 2021. We might not see an unemployment rate below 4.0% until 2024. With every passing day, the lockdowns take an increasing toll; the sooner they end, the better.

Consensus forecasts come from Bloomberg. This report was prepared by First Trust Advisors L. P., and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

https://www.ftportfolios.com/Commentary/EconomicResearch/2020/5/26/signs-of-economic-life

How Are We Going To Pay For All This?

May 18, 2020

Brian S. Wesbury – Chief Economist, Robert Stein, CFA – Dep. Chief Economist, Strider Elass – Senior Economist, Andrew Opdyke, CFA – Economist, Bryce Gill – Economist

The largest federal budget deficit since World War II came back in 2009, as slower growth and increased government spending during the subprime-mortgage financial panic pushed the deficit to 9.8% of GDP. This year’s budget deficit will, quite simply, blow that record out of the water.

The Congressional Budget Office recently totaled up all the legislative measures taken so far – as well as the effects of a weaker economy (payments for unemployment benefits would be going up even with the recent law) – and they estimated this year’s budget deficit at $3.7 trillion, which they forecast would represent about 18% of GDP.

As if that weren’t enough, the House of Representatives just passed a bill that would add another $3 trillion to the debt. Although a detailed year-by-year cost estimate isn’t yet available on the spending provisions, and the bill is dead-on-arrival in the Senate, which isn’t going to rubber stamp that proposal, it’s likely Congress and President Trump will end up compromising on some sort of additional measures that drive the deficit even higher. As a result, we’re guessing the budget gap for the current fiscal year ends up closer to $4 trillion, or about 20% of GDP, the highest since 1943- 45.

Given the economic crater generated by the Coronavirus and related shutdowns, as well as the heavy-handed legislative response, budget deficits will be enormous in the years ahead, too.

Despite these sky-high numbers, it’s important to recognize that the US government is not about to go bankrupt. The debt, while large (and growing), remains manageable. Before the present crisis, the average interest rate on all outstanding Treasury debt, including the securities issued multiple decades ago, was 2.4%. Now, our calculations suggest newly issued debt is going for about 0.25%, on average, which applies to both the recent increase in debt as well as portions of pre-existing debt coming due and getting rolled over at lower interest rates.

When debt that costs 2.4% gets rolled over at around 0.25%, that’s a great deal for future US taxpayers. The problem is, the Treasury Department has been decidedly stubborn about not issuing longer-dated securities – think 50 and 100-year bonds – that would allow taxpayers to lock-in these low interest rates for longer, making it easier to spread out the cost of the extra debt incurred throughout the crisis.

As a result, if (or more like when) interest rates go back up, the interest burden generated by the national debt could go up substantially.

The best move the Treasury Department could make would be to use the recent surge in debt to overhaul the kinds of securities it issues. One idea that deserves exploring is replacing all securities with a maturity of over, say, 2 years, with “perpetual” or “interest- only debt.” No principal would ever have to be paid on these instruments; they’d just pay the same nominal amount of interest twice per year. If we want to mix it up a bit, some debt could pay interest with gradual adjustments for inflation, just like TIPS.

This is not a new idea. The British issued perpetual bonds starting in the 1750s, and the last ones were retired in 2015. And although they’re called “perpetual” bonds, and they’re not callable, the Treasury Department could always buy them back at market prices to retire them.

Liquidity should not be an issue. Every time the government needs to issue longer-dated securities, it could simply re-open that very same security. Then the private sector could slice and dice them, on demand. If someone needs a 10-year zero-coupon Treasury note, just take the interest payment due in ten years and package that into a stand-alone security. Want something like a traditional 30-year? An investment firm can package a stream of interest payments over the next 30 years and tie it to a big package of payments due in exactly thirty years.

But it’s not only the debt generated by recent fiscal measures that will burden future generations. Overly generous unemployment benefits are disincentivizing many unemployed workers from re- joining the labor force, which slows the process of accumulating skills. Widespread government-mandated closures also hinder skill- formation, as well as risk destroying some (or all) of the know-how embedded in business’s operations.

Yes, the debt is a burden on future taxpayers. In this way, the fiscal response magnifies the effects of other responses to the Coronavirus. So far, the age of the typical person who has died with the virus has been about 80 years old. Right or wrong, our government – and society in general – has taken enormous measures to contain the virus to save the lives of our elderly population, and these moves have imposed enormous costs disproportionately borne by the younger generations who are out of jobs, school, and business opportunities. The very same group who will be paying the costs well into the future.

Consensus forecasts come from Bloomberg. This report was prepared by First Trust Advisors L. P., and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

S&P 3100, Dow 25750

May 11, 2020

Brian S. Wesbury – Chief Economist, Robert Stein, CFA – Dep. Chief Economist, Strider Elass – Senior Economist, Andrew Opdyke, CFA – Economist

Bryce Gill – Economist

In December 2018 with the S&P 500 at 2,500, we forecast it would hit 3,100 by the end of 2019 and then pushed our forecast to 3,250 as stocks soared. The S&P 500 rose 28.9% in 2019 and hit that revised target on the first day of trading in 2020.

We then raised the target to 3,650 for the end 2020, and the way stocks were moving higher in January and February made that forecast look reasonable. But then the world took a detour into the Coronavirus Contraction. As a result, we are adjusting our year-end 2020 target down to 3,100, with the Dow Jones Industrials average finishing at 25,750. That would be a moderate gain of 5.8% from the Friday close.

The range of plausible outcomes for the rest of 2020 is very wide right now. Key variables include factors that are normally irrelevant to forecasting markets such as the spread of the Coronavirus, how quickly the economy opens, the development of therapies or a vaccine to fight the disease, and how quickly people are willing to go back to normal.

With the economy getting crushed, some analysts are wondering how equities could have bounced so hard from the March lows. We understand their confusion. With unemployment likely above 15% and real GDP falling roughly 30% in Q2, how can equities be doing so well?

One key to understanding this is that investors don’t buy shares of GDP, they buy ownership stakes in a distinct set of companies, many of which are doing quite well despite the general economic carnage.

Imagine a company that has a major competitor nearby. One day, completely out of the blue, the competitor’s facilities are all destroyed by a meteor. Obviously, no one would celebrate this catastrophe. However, when competitors go away the enterprise value of the surviving company rises, and you don’t have to be an astrophysicist to figure that out.

In many ways, the spread of the Coronavirus has given larger well-capitalized companies, particularly technology companies and big box stores that were allowed to stay open, an advantage over Main Street competitors. And unlike Main Street businesses, a larger share of these companies are publicly traded.

Meanwhile, our capitalized profits model for equities, based on profits and interest rates, suggests a 3,100 level for the S&P 500 would not be overvalued. To put this in context, a 3,100 level assumes that profits fall by 60% AND the yield on the 10-year Treasury Note climbs to 1.25%. We forecast profits will fall about 25% this year and the 10-year Treasury will rise to just 0.9% by year-end. In other words, even at 3,100 we believe the S&P 500 will still be undervalued. And with profits rising in 2021, we think the S&P 500 can then rise to 3,650, a year later than we originally forecast.

One reason to be bullish on equities is that these days Quantitative Easing by the Federal Reserve is going straight into the M2 money supply and not into excess reserves. In the past three months, M2 has climbed at a 66% annualized rate, the fastest rate we know of in history.

Meanwhile, the federal government has ramped up deficit spending (with unemployment insurance and loans/grants to small businesses) to try to offset private-sector losses in income. Regardless of what we think of these policies, the effect will be to support equity prices in the year ahead.

Consensus forecasts come from Bloomberg. This report was prepared by First Trust Advisors L.P., and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

https://www.ftportfolios.com/Commentary/EconomicResearch/2020/5/11/sp-3100,-dow-25750

Light at the End of the Tunnel

May 4, 2020

Brian S. Wesbury – Chief Economist, Robert Stein, CFA – Dep. Chief Economist, Strider Elass – Senior Economist, Andrew Opdyke, CFA – Economist, Bryce Gill – Economist

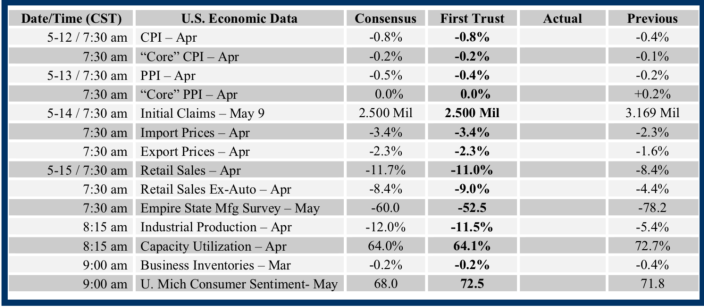

When the employment report for April is released this Friday, the economic damage from the deepest of the Coronavirus shutdowns will become clear. We estimate that nonfarm payrolls will be down roughly 22 million versus March, and the unemployment rate will skyrocket to around 17.0%, the highest reading since at least 1948.

To put that in perspective, during the subprime-mortgage panic of 2008, payrolls declined 8.7 million over a 25-month period. Now, it looks like we lost almost three times as many jobs in just one month. The highest unemployment rate since the wind-down from World War II was 10.8% at the end of the 1981-82 recession. The jobless rate peaked at 10.0% after the Great Recession.

Unfortunately, we expect the unemployment rate to be even higher in May, and it is very difficult to believe that $2.5 trillion in government spending offset more than 50% of the damage. We hope we are wrong about that, but promising money to companies for payroll expenditures – but then not allowing them to open or letting them open at only 25% capacity – will not save many restaurants or bars.

While the economic damage is horrific, there are some positive signs. While 30 million workers filed for unemployment benefits in the past six weeks, those currently receiving benefits (what are called “continuing claims”) are up a smaller 16 million in the first five weeks of that period and will be up around 20 million for the full six-week period. Yes, that’s still awful, but it tells us that the Payroll Protection Plan and areas of actual job creation, such as online retailing and delivery services, are offsetting some of the damage.

This kind of job destruction will be accompanied by a very large decline in GDP. We’re estimating a contraction at a 30% annual rate in the second quarter. But everyone already knows that.

We won’t get that data until late July, and by then we expect the economy to be expanding, albeit from a low base. In fact, we already see some light at the end of the tunnel. During the week ending Saturday May 2, 939,790 passengers went through TSA checkpoints at airports. That’s up 26% from the prior week and up 40% from two weeks ago. The amount of motor gasoline supplied has grown three weeks in a row, and is up a total of 16%. Hotel occupancy and railcar traffic are both up from a month ago. These high-frequency data will give a clearer read on the pulse of the economy as we gradually reopen.

Yes, activity is still down substantially from year-ago levels, or even those in January, but we are beginning to see signs of life. It’s a sign that the animal spirits are not dead.

Anyone who ventures outside will notice more cars on the road and more activity, including in businesses that are still required to be closed to the public but are preparing for clearance to re-open. Many researchers are using cell-phone location data to track the movement of people. For example, Apple looks at “routing requests” on map applications. In mid-April, both walking and driving requests were down roughly 60% from January 13th. As of Saturday, walking and driving requests were only down 29% and 16%, respectively.

As we noted last week, we will continue following “high frequency data” like those above. This recession will be brutal, the worst of our lifetimes. But it is not a normal recession, and it will also be short. Investors should keep in mind that, although the weeks ahead will be tough, there are better days beyond them.

Consensus forecasts come from Bloomberg. This report was prepared by First Trust Advisors L. P., and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

https://www.ftportfolios.com/Commentary/EconomicResearch/2020/5/4/light-at-the-end-of-the-tunnel