Month: June 2020

Not Locking Down

June 29, 2020

Brian S. Wesbury – Chief Economist

Robert Stein, CFA – Dep. Chief Economist

Strider Elass – Senior Economist

Andrew Opdyke, CFA – Economist

Bryce Gill – Economist

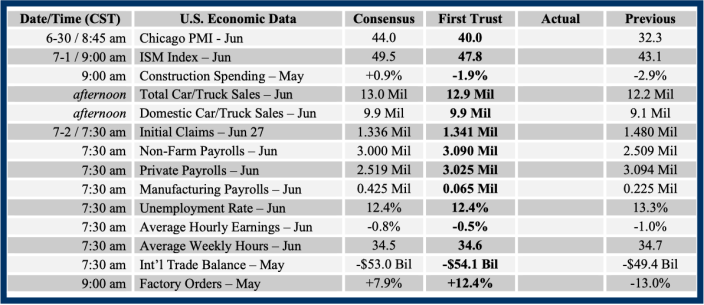

A resurgence of new Coronavirus cases around the country has created uncertainty for investors. Stock markets fell last week, not because of the virus, but because investors fear another round of economy-killing, government-mandated lockdowns. We don’t expect that to happen, but when the government is involved, risks are definitely higher.

After the peak in early April, the seven-day moving average for new cases bottomed on June 9 at 21,282. Since then, they’ve surged, hitting 39,662 per day in the seven days through yesterday. That’s an 86% increase in only 19 days. (Daily volatility in the data, especially over the weekend, makes it important to look at seven-day moving averages.)

Some of the increase in new cases is due to more testing, but not all of it. States where the number of cases has increased the most include Arizona, Florida, Texas, Mississippi, Nevada, South Carolina, and California. There is some tentative evidence that the rise in cases has been driven by higher summer temperatures in hotter states, where air-conditioned restaurants and bars have reopened. It is also not a coincidence that cases (even in states that started lifting restrictions in early May) surged after recent social unrest (both peaceful and otherwise). And, if we had more testing capacity back in April, antibody tests suggest that we would have seen many more cases than were actually reported.

Either way, while cases have increased, deaths from the virus have not. According to data from Worldometer, in the seven days ending Sunday, deaths averaged 596 per day nationwide, the lowest since March, and are down almost 75% from the peak in mid-April. In fact, in spite of all the negative publicity focused on some southern states, New York had 39 deaths per day in the seven days through Sunday, versus 36 each for Florida and Arizona, and 30 for Texas.

The average age of those testing positive for the virus appears to be falling, and we know younger and healthier individuals rarely get severe outcomes. Also, it appears that doctors and nurses have learned a lot about treating patients with the virus. This helps explain why cases have risen, but deaths have not.

As a result, although some states and cities have re-imposed density limits on people congregating, we highly doubt we’re headed back to broad April-style restrictions. The virus will be with us, until it is not. Social distancing may slow the spread, but can’t stop it. People and businesses are adapting. They want to get back to normal.

In spite of the “surge” in new cases, the TSA reports that the number of airline passengers going through checkpoints in the week through June 25th was up 12% versus the prior week. TSA data show a steady and uninterrupted increase in passengers since bottoming back in April. No wonder airlines are adding back flights and letting passengers know some of their flights will be full. In other words, the data show that economic activity continues to rebound from the widespread shutdowns.

We still project that the recovery process is going to take years; we don’t expect an unemployment rate at or below 4.0% until at least 2023. However, even with a steep drop in corporate profits in the second quarter, in the current low interest rate environment our model still says stocks are cheap, suggesting we are unlikely to see the market retest its lows.

Consensus forecasts come from Bloomberg. This report was prepared by First Trust Advisors L. P., and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

https://www.ftportfolios.com/Commentary/EconomicResearch/2020/6/29/not-locking-down

Saving and the Shutdown

June 22, 2020

Brian S. Wesbury – Chief Economist

Robert Stein, CFA – Dep. Chief Economist

Strider Elass – Senior Economist

Andrew Opdyke, CFA – Economist

Bryce Gill – Economist

Turning off the global economic light-switch, and then turning it partially back on, has sent shockwaves through economic data that, while anticipated, have been jaw-dropping in both directions.

For example, US retail sales plunged a combined 21.8% in March and April, before rising 17.7% in May. Manufacturing production fell 20.0% in March and April, before gaining 3.8% in May. Nonfarm payrolls shrank 22.1 million in March and April, followed by a gain of 2.5 million in May. The savings rate surged to 33% in April, the highest rate ever recorded with current metrics.

This week we’ll get some fresh numbers on home sales, orders for durable goods, and personal income and spending, and we expect it to be a mixed bag. Existing home sales are counted at closing, so the data for May was very weak, as closings in May reflect contracts signed in the lockdown months of March and April. New home sales in May should be better, because those are counted when contracts are signed, and lockdowns had been relaxed. New orders for durable goods should also look better after a 31.5% drop, combined, in March and April. Businesses investment plans froze during the lockdown and, in some cases, previously-made orders were cancelled. Now, orders should start to revive.

But the oddest report this week is going to come on Friday, when we get personal income and spending data for May. Remember, personal income surged in April, rising 10.5%. Normally, increases in personal income are a good sign, but not this time. Both private-sector wages & salaries and small business income plummeted.

Personal income soared in April because the government handed out checks (transfer payments), mostly in the form of one-time payments to taxpayers, but also through increased unemployment benefits. In other words, the US borrowed from future generations to keep income up for the current generation during the COVID shutdown.

But while transfer payments boosted income, spending fell for two reasons. First, people were locked inside, which restrains spending. And, second, many stores, restaurants, bars, theaters, and all kinds of other businesses, were closed anyway. The result: the savings rate surged to 33%, the highest level on record going back to at least 1959. Before this, the highest saving rate for any month before April was 17.3% in May 1975.

In total, the annual rate of government transfer payments rose by $3 trillion, while the annual rate of spending fell by $1.9 trillion. Factoring in the drop in other forms of income (like wages & salaries and small business income), annualized saving grew by $4.0 trillion in April. This means 75% of the burst in savings came from government transfer payments.

But what happened in April was a fluke that should reverse in May, as the one-time IRS payments dwindle and consumer spending rebounds. What happened was artificial, due to the economic shutdown and government reaction. While some of the rise in savings is pent-up demand, this savings rate is artificial, and reflects borrowing from the future. The shutdown destroyed wealth, and importantly, wealth-creating capacity. The artificially high savings rate should not be taken as a sign that all will be well.

Ultimately what matters is how much private-sector income revives, and how quickly. The early stages of the recovery will look like a “V,” but we still anticipate a full recovery is years away: real GDP won’t hit the level of late 2019 until at least the end of 2021; the unemployment rate won’t be back down to 4.0% or below until 2023.

Entrepreneurs and innovators made great strides in the past few decades. Now, they have their work cut out for them digging out of the hole created by the shutdowns. Future growth will depend on how rapidly the government can end the lockdowns, and unwind the extraordinary measures taken over the last few months.

Consensus forecasts come from Bloomberg. This report was prepared by First Trust Advisors L. P., and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

https://www.ftportfolios.com/Commentary/EconomicResearch/2020/6/22/saving-and-the-shutdown

The Fed is Committed to Low Rates

June 15, 2020

Brian S. Wesbury – Chief Economist

Robert Stein, CFA – Dep. Chief Economist

Strider Elass – Senior Economist

Andrew Opdyke, CFA – Economist

Bryce Gill – Economist

The one key takeaway from last week’s Fed meeting is that monetary policymakers are set to keep short-term interest rates near zero for as far as the eye can see. Not forever, but at least until 2023. Keep this in mind in the week ahead, as we get more reports confirming the economic recovery started back in May.

The Federal Reserve conveyed that commitment in a few different ways. First, and most important, was the quote from Wednesday’s post-meeting press conference with Fed Chairman Jay Powell that the Fed is not even “thinking about thinking about raising rates.” In other words, raising rates is not even on their radar.

Second, the “dot plots,” which show how many Fed officials think short-term interest rates will finish at various levels in the next few years, showed that not a single one of the seventeen officials offering a forecast thinks there will be a rate hike this year or next. Only two of the seventeen think there will be a rate hike in 2022.

Third, the Fed’s economic forecast shows they think the unemployment rate will finish 2022 at 5.5%. That’s important because in the aftermath of the Financial Crisis in 2008-09, the Fed didn’t raise short-term interest rates again until December 2015, when the jobless rate had fallen to 5.0%. At present the Fed expects the unemployment rate to finish this year at 9.3%, next year at 6.5%, and 2022 at 5.5%. So, if the Fed’s forecast for the unemployment rate is right, and it stays consistent with how it reacted coming out of the last recession, that suggests it would not be raising rates until mid-2023.

However, there is also the possibility that the Fed waits even longer to raise rates this time around, or, if it starts at a similar point (5.0% unemployment), might raise rates even more slowly than it did in the prior cycle.

The Fed’s favorite measure of inflation is the personal consumption expenditure (PCE) deflator. From the peak in the business cycle in December 2007, through the peak in the most recent expansion in February 2020, the PCE deflator increased at an average annual rate of 1.5%. From the bottom of the recession in June 2009, through the bottom of the recent recession in May 2020, we estimate that the PCE deflator rose at a 1.4% annual rate.

Either one you pick – peak-to-peak or trough-to-trough the deflator averaged less than the 2.0% level the Fed has repeatedly said is its long-term target for average inflation. Moreover, Fed statements have been asserting that its 2.0% inflation target is “symmetric,” which means the Fed wants to see inflation be above 2% as much as it is below 2.0%.

Given all this, we think the Fed would like to see inflation run higher than it did in the prior economic expansion and will be even more hesitant to raise interest rates. They will err on the side of too much inflation, rather than too little.

The good news is that the Fed seems reluctant to adopt two other policy tools, both of which we believe would be major mistakes. The first tool, negative interest rates, are essentially a tax on the financial system, and tend to embed expectations of weak GDP growth in the countries that have tried them.

The second tool, “yield curve control,” has the Fed committing to keeping medium- or longer-term interest rates at or below a certain level. For example, the Fed could commit to making sure the yield on the 5-year Treasury Note is at or below 0.35%, buying potentially unlimited amounts of Treasury debt to target that goal. The problem with yield curve control, is that it decimates price signals coming from the Treasury market, substituting centralized monetary planners’ judgements for the collective wisdom of the free market.

In the meantime, this week’s reports should show that the economy was healing before the Fed’s meeting. Retail sales, industrial production, and housing starts should all be up sharply for May, and we expect a continued decline in claims for unemployment insurance, as well. We are still a long way off from being fully recovered, but the process has to start somewhere. In May, the recovery began.

Consensus forecasts come from Bloomberg. This report was prepared by First Trust Advisors L. P., and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

The Recession is Over

June 8, 2020

Brian S. Wesbury – Chief Economist

Robert Stein, CFA – Dep. Chief Economist

Strider Elass – Senior Economist

Andrew Opdyke, CFA – Economist

Bryce Gill – Economist

The recession that started in March is the sharpest downturn since the Great Depression. As it turns out, it was also the shortest.

Friday’s employment report should leave little doubt that the US economy has already hit bottom and is starting to recover. Every economist brave enough to make a public forecast thought nonfarm payrolls would drop in May and the unemployment rate would continue to rise. Instead, it was the opposite: nonfarm payrolls rose 2.5 million, and the unemployment rate dropped to 13.3%.

This doesn’t mean the US is fully recovered, or even close; a full recovery is going to take at least a few years. But look for more positive numbers from here on out, including next week’s reports on retail sales, industrial production, and home building.

Paul Krugman tweeted the possibility of the Trump Administration cooking the books, but that’s absurd. Jason Furman, one of President Obama’s top economists, pointed out that the Bureau of Labor Statistics has 2,400 career staffers and only one political appointee, with no ability to cook the books. The odds of a conspiracy among these career civil servants to help the Trump Administration are zero.

Some analysts have been saying that the unique nature of the economic downturn has made the unemployment rate unreliable, because, for example, PPP loans have allowed furloughed workers to be paid, even though they aren’t working, so technically, some say, they are unemployed. Counting these workers as unemployed would have put the jobless rate at 16.3% in May versus the official report of 13.3%.

However, using the same method in April would have meant that jobless rate would have been reported as 19.5%, not the official estimate of 14.7%, which means the drop in the jobless rate in May would have been 3.2 percentage points (19.5% to 16.3%), not the 1.4 points reported Friday. And it’s the change in the unemployment rate that matters for financial markets.

Meanwhile, initial jobless claims fell for the ninth consecutive week, and continuing claims remain below the peak hit in the week ending May 9, both consistent with an economy that is already hit bottom.

Another piece of evidence supporting the case for a recovery is that tax receipts look better. Every day the Treasury Department releases figures on various categories of tax receipts. These receipts vary wildly depending on the day of the week and the time of the month, so we like to compare them to 2015, because that was the last year the number of days in March through December fell on the same days of the week as 2020.

In the past five workdays, the Treasury collected $56.8 billion individual income and payroll taxes withheld from paychecks, up 11.8% from the same days in 2015. A month ago, in early May (specifically, the five workdays through May 7), these receipts were up 7.1% versus 2015. This acceleration signals the economy has turned a corner.

Which brings us to our outlook for equities. A month ago, with the S&P 500 at 2930, we projected that stocks would recover to 3100 by year end. But now we’re barely under 3200. We continue to expect more gains, but don’t expect it to be a straight line, with the S&P 500 finishing the year around 3350 and the Dow Jones Industrials average at 28,500.

Profits will be down substantially in the second quarter, but should recover strongly in the several quarters thereafter. Meanwhile, the money supply is growing rapidly, and the Federal Reserve is prepared to keep monetary policy loose for the foreseeable future, as should be clear after Wednesday’s meeting.

The US has gone through tremendous turmoil so far this year, with a response to COVID-19 that included unprecedentedly widespread government-mandated economic shutdowns, followed by a combination of legitimate protests, riots, and looting. No one knows for sure what the second half will bring, much less 2021 and beyond. But we think that, like in the past, those who have faith in the future will be rewarded.

Consensus forecasts come from Bloomberg. This report was prepared by First Trust Advisors L. P., and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

More Green Shoots

June 1, 2020

Brian S. Wesbury – Chief Economist, Robert Stein, CFA – Dep. Chief Economist , Strider Elass – Senior Economist, Andrew Opdyke, CFA – Economist, Bryce Gill – Economist

A full recovery from the COVID-19/Shutdown Crisis is going to take a long time. We don’t anticipate reaching a new peak for real GDP until the end of 2021; we don’t anticipate a 4% unemployment rate until 2024.

However, there is a growing amount of evidence that the economy may have hit bottom in May. It’s important to be cautious; the evidence for having hit bottom already is not definitive or bulletproof. And, given the steepness of the economy’s decline versus how fast it will recover, production in June may still be lower than in May even if we’ve already hit the inflection point.

But the most important piece of economic news last week was that regular continuing unemployment claims declined 3.86 million to 21.05 million, the first drop since the end of February. That’s still an astronomically high number compared to historical norms: the peak in the aftermath of the 2008-09 Financial Crisis was 6.64 million.

But, as we pointed out last week, recession typically end sometime between the peak of initial claims (late March) and the peak in continuing claims (possibly mid-May), so the deepest recession since the Great Depression looks increasingly likely to be the shortest, as well.

The news often reports the total number of people who have filed new claims for unemployment benefits, and the total is more than 40 million people in the past ten weeks. But it’s not true that we have that many unemployed. Some claims are fraudulent, and some people have been called backed to work. It’s also true that the CARES Act widened the eligibility for benefits, making them available to some business owners, self-employed workers, independent contractors, and others. Including all these categories of unemployment benefits, the total number receiving benefits is closer to 30 million from the start of the crisis, not the oft reported 40.

One problem that will impede the pace of the recovery is the unusual generosity of unemployment benefits. A recent paper from the University of Chicago shows that 68% of workers who are eligible for unemployment checks are getting benefits that exceed their lost earnings, and that half of those getting benefits are receiving at least 34% more than their lost earnings.

Despite these hurdles, green shoots continue. TSA says 268,867 passengers went through security on Saturday, up 39% from two weeks ago and up 187% from the worst Saturday, which was April 11. Motor vehicle gas supplied is up 24% from a month ago. Yes, these numbers are still down substantially from a year ago, but a recovery has to start somewhere.

And whatever your thoughts on the recent social upheaval – ranging from legitimate and peaceful protests by law-abiding citizens, to looting by criminals and riots instigated by junior wannabe-Bolsheviks – it’s going to be hard in the weeks ahead for governments to enforce stricter lockdowns than people are willing to voluntarily observe. In turn, that could foster the further growth of the green shoots we’ve seen already.

Consensus forecasts come from Bloomberg. This report was prepared by First Trust Advisors L. P., and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

https://www.ftportfolios.com/Commentary/EconomicResearch/2020/6/1/more-green-shoots